I dislike overpriced luxury goods. Like a 37 500 US$ pen, which is functionally equivalent to a 10 US$ pen, which is not much better than a 0.5 US$ pen. Now, buying this is stupid if you are a UAW union official using misused funds. But, more generally, it reminds me of our unjust, inequitable distribution of wealth. And I dislike it because I am part of that system.

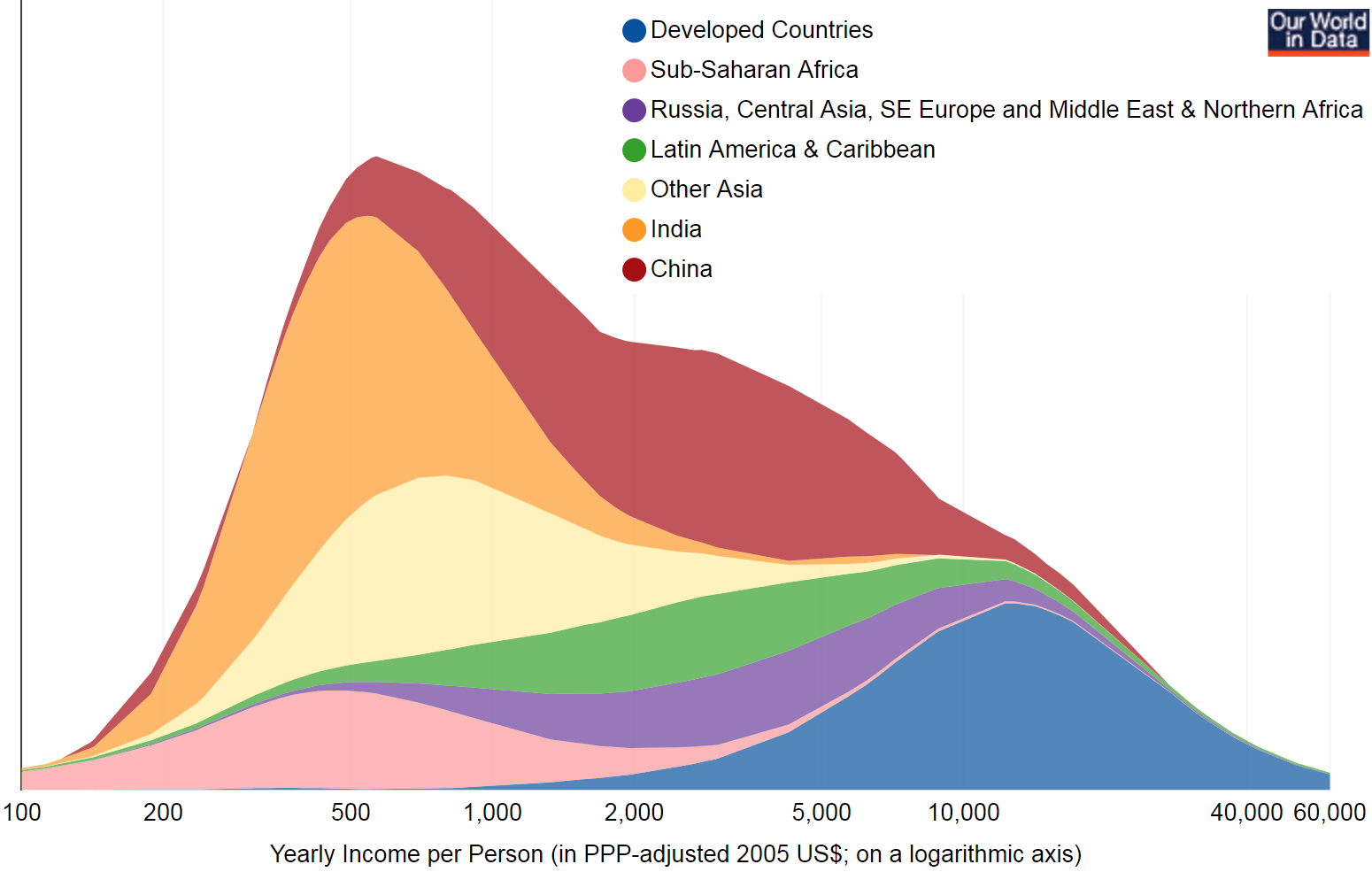

As a German, my footprint is around 5.3 global hectares. Australians (9.31 gha) or U.S. Americans (8.22 gha) are worse, but does that help? With a global average of 1.73 gha or 1.16 gha in India, we all have a long way ahead of us. There is no denying: We live our Western European lifestyle at the expense of poorer countries. And although we have hidden some inequality by separating rich and poor countries, enough remains in each country. Income inequality in the developed world is drastic (and increasing). Take a look at the following graph of the global and regional situation in 2011:

In fact, any mid-sized, good-value-for-money car is a sign of injustice. Our world will collapse if all 7.5 billion humans (10 billion soon) want to drive such a car.

But I don’t dislike such cars the same way as I dislike “luxury goods”. I think the reason is that I read the display of luxury goods (including expensive fashion items) as a statement: “I know about inequality but feel good about it.”

Still, recently I started to think about it differently. Faced with the dilemma what to do with ones excess income and wealth, one may (a) donate it for good purposes, (b) invest it for later use, (c) use it at good value (like flying a private jet around the world), or (d) buy totally overpriced fashion clothes.

With respect to ecological footprints, luxury goods may be a moderately beneficial option 😊.

So what is the most ecologically perverse form of investing your money?

Perhaps the much-applauded bitcoin system? Without a trusted central bank charged with limiting money supply and preventing inflation, the inventors of the bitcoin system had to tie the bitcoin money supply to constraints of the physical world. The chose the cost of computing hardware and energy. The bitcoin algorithms guarantee that for every new bitcoin number verified and added to the currency an enormous amount of natural resources must be used (see, e.g., this article). Bitcoin and Ethereum use more electricity than Iceland (Coppock 2017)!

Reblogged this on blog.weitzenegger.de.

LikeLike